We deployed a 0.0001% ETH/USDC Uniswap V4 pool

On mainnet, liquidity providers get constantly attacked by MEV bots using arbitrage or sandwiches. Uniswap V4 pool have constant fees, therefore pools cannot charge higher fees for MEV.

But what if they could? This is why we built MEVSwap, a Uniswap V4 hook.

With MEVSwap, liquidity providers can earn from MEV instead of being subject to it. Bots compete to swap on the pool via an offchain auction that is settled onchain using builder refunds. This allows us to create extremely low fees, yet capital efficient Uniswap V4 pools.

We wanted to know just how efficient it could be. In order to test this scenario, we deployed a 0.0001% ETH/USDC pool on mainnet without the MEVSwap hook.

We deposited just ~$30k with a -/+ $200 range of the active tick at the time (~$1840).

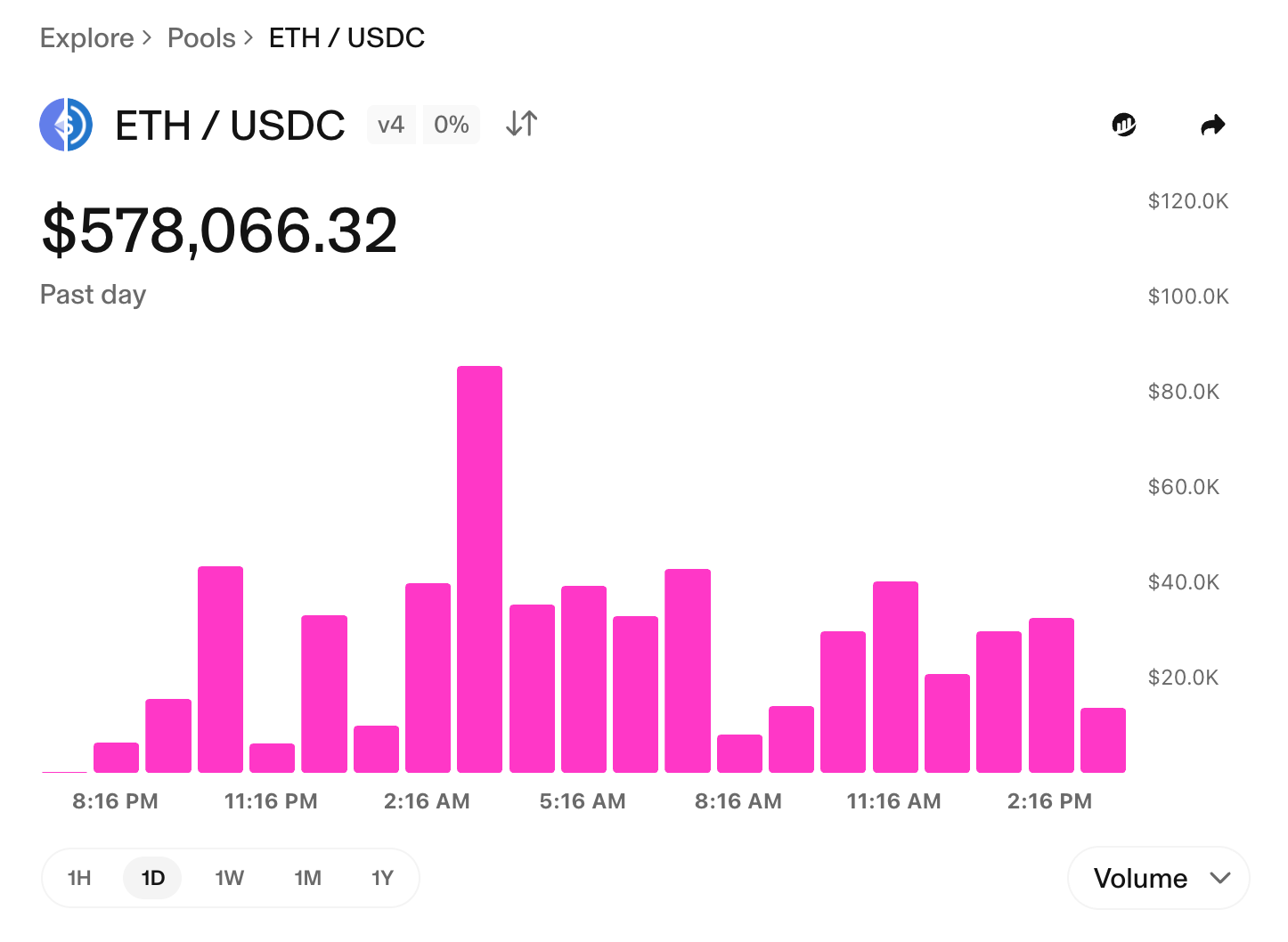

Over 12 hours, more than $500,000 was routed through our new pool. With just $30k in liquidity, that's over 16x the liquidity in volume.

Some aggregator such as 1inch, Li.Fi, Pendle and CowSwap started routing liquidity natively to this pool

We were able to get 10% of all Uniswap V4 ETH/USDC volume with 200x less liquidity.

However, this kind of LPing is not profitable ... without the MEVSwap hook.

Starting today, LPs can deposit funds into MEV-protected pools.

Wallets wanting to integrate MEVSwap into their swapping UI to provide better quotes and lower fees to their users can get in touch with us.

merkle protects wallets, RPC providers and trading terminals against MEV.

Integrate in minutes and get best-in-class MEV protection with second to none revenue generation.

Book a Call